Building your investment plan…

In our eBook we aim to demystify property investing and show you how to build a large passive income using simple tried-and-tested strategies.

In fact, we lay out the exact plan for generating an ongoing income of $83,200 pa. by buying just 4 average-priced investment properties.

And because this income is derived from rent it keeps growing year in, year out… eventually doubling to $166,400 pa. and then beyond.

Our core property investment strategy is also completely ‘passive’ – unlike the case with property development and renovation. This means you get to focus your time and energy on your job/business and your family & friends, rather than getting weighed down by the demands of managing a big renovation or development project.

But the key to all of this is to actually take action and properly execute on your investment plan…

Unfortunately, many investors come unstuck when they unnecessarily over-complicate things; stray from their original investment plan; or worst of all, buy the wrong property in the wrong area and therefore fail to achieve the level of capital growth needed to build real wealth.

Remember, a property averaging 4% annual capital growth will take 18 years to double in value, whereas a property growing at 8% will double in value in just 9 years – that’s a significant difference!

Note: To learn how to build an investment plan download a copy of our eBook, or alternatively check out our 7-part property investing email series.

Finding the best locations to buy in…

Anyone can buy an investment property but if you want to create wealth and an ongoing income you need to buy high-yielding property in areas with excellent long term capital growth prospects.

For strong cash flow you need to buy the right ‘type’ of property and for capital growth nothing is more important than the ‘location’ you choose to buy in.

We recently wrote an overview of how you can ‘beat the market’ when investing in property, however in this article we’re going to get into the specifics of where you should invest, and why.

As you know the various property markets around Australia differ greatly at any one time so it’s crucial to research which areas are on the way up, and to avoid those that have already peaked, or are on the decline.

This often means you need to look outside of your own suburb and state if you’re serious about finding the very best performing and up-and-coming areas.

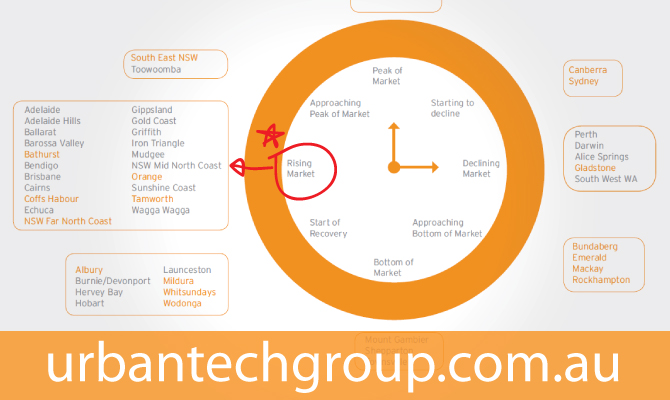

For a snapshot of the current market here’s the latest ‘property clock’ from valuation and advisory group Herron Todd White;

To view a larger full version click here

As a buy & hold investor you need to be considering buying property in the locations listed in the ‘Rising Market’ segment of the property clock.

The challenge, is then to identify the ‘best of the best’ areas to invest in based on 3 core factors;

- Affordability – it goes without saying; if you can’t afford to buy a property in an area, you can’t invest in it! The good news is areas with an affordable median-price tend to grow faster overall;

- Rental Return/Yield – if the yield is too low your holding costs become prohibitive and can limit you from buying more property. You should look for a yield of at least 5% – preferably higher, so the property can be positively geared;

- Long-term Capital Growth – to build wealth you need capital growth. If you buy in an area with low capital growth it will take you many years longer to achieve your goals. Areas that experience solid year in, year out, capital growth are best. You can find these areas by analysing supply & demand trends as well as by researching fundamental growth drivers.

So what do we think is currently the best location to invest in as a buy & hold investor?

The answer is…

South-East Queensland!

It’s great to see Adelaide in the rising market segment of the property clock, and there’s certainly some solid investment options here for local SA investors, however based on our market research there’s little doubt that South-East Queensland [SEQ] is the location best positioned to be the standout performer [for both cash flow & capital growth] over the coming years…

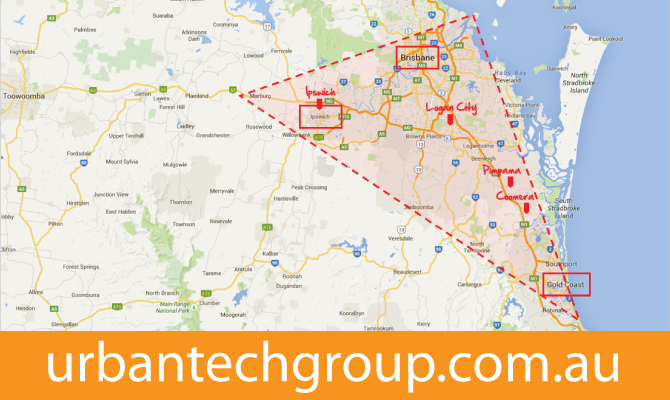

More specifically, the ‘Growth Corridor’ between the Gold Coast and Brisbane which includes locations such as Ipswich, Logan City, Pimpama and Coomera.

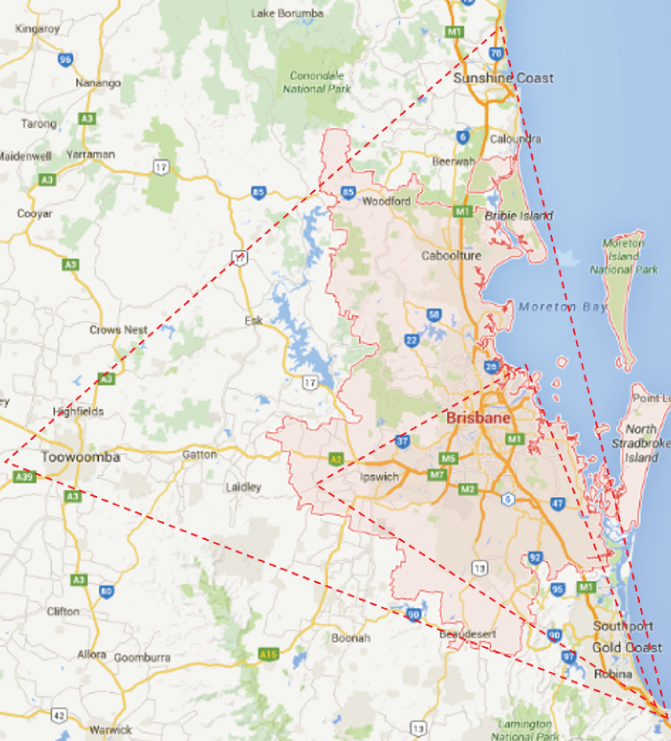

These areas also form part of a larger SEQ region often referred to as the ‘Golden Triangle’.

You can see the locations on the maps below;

Growth Corridor – Brisbane & Ipswich to Gold Coast

The Golden Triangle – Sunshine Coast to Toowoomba to Gold Coast

Some of the key fundamental drivers for the SEQ region are population growth, strong employment, proximity to amenities, a plethora of infrastructure projects, and a limited supply of land. [It’s estimated there’s only 9 years’ worth of residential land left to develop between Brisbane and the Gold Coast.]

South-East Queensland is currently in the middle of an infrastructure revolution with more than $15 billion committed thus far on; underground tunnel networks, upgrades to motorways, a second gateway bridge, upgraded and extended rail links, utilities, public hospitals, universities, business and commercial parks, international sporting facilities and long term tourism infrastructure projects.

Brisbane 2032 Olympic Games

And then there’s the Brisbane 2032 Olympic Games – which KPMG has estimated will deliver over $8.1 billion in direct economic benefits to the QLD economy and create 91,600 jobs over the next 20 years!

Brisbane’s selection as the host city for the 2032 Olympics brings with it a promising array of economic benefits, with one of the most notable being the potential for substantial property price growth.

As the city prepares to welcome athletes and visitors from around the world, significant infrastructure investments will be made, such as the construction of state-of-the-art sports venues, transportation improvements, and urban development projects. These enhancements will not only enhance the quality of life for residents but also boost the appeal of Brisbane as a desirable place to live, work, and invest.

Consequently, the city is likely to experience a surge in property values as demand for real estate surges, fostering opportunities for homeowners and property investors alike.

This positive ripple effect of increased property prices can stimulate economic activity, generate new jobs, and contribute to the long-term prosperity of the city.

Based on our research there is no doubt that Brisbane will outperform all other capital cities and will become the best property market in Australia over the next 3 years and beyond.

But don’t take our word for it…

Rather that present you with an endless list of hand-picked articles that support our thesis, we invite you to jump online and do your own research on the future prospects of Brisbane and the greater South-East Queensland region. We know you’ll be impressed by what you find!

How we can help…

Through our Real Investar Program we can help you develop and implement a property investment plan.

In simple terms, we’ll work with you to set a passive income goal, then we’ll help you buy the right property in the right areas so you can achieve your goal in the shortest amount of time.

We can take care of everything from finding the property and arranging finance to helping you get the right tenant.

>> For more info and to get started click here

If you need any other details or just want to chat further, please contact Sam on 0411 431 391

Cheers

Sam C

Real Investar

Property Investment Advisor

0411 431 391

sam@realinvestar.com.au